Optimising Anti-money Laundering solution through Robotic Process Automation

Robotic Process Automation (RPA) is the application of technology, which is executed using business logic and structured inputs in order to automate business processes. The term “robotic process automation” was first introduced in 2000 and has since evolved from screen scraping to automating devices at a larger scale. With the support of Artificial Intelligence and Machine Learning technologies, robotics solutions are being implemented to simplify the process of digital transformation in businesses. With the increase in workflow, there has been an increase in demand for automation and robotics solutions are aiding in replicating human interaction with digital systems and at the same time be cost-effective and time efficient. RPA has played a crucial role across industries including Financial Sector, Human Resources, and Healthcare to eliminate human errors and simplify complex tasks in businesses.

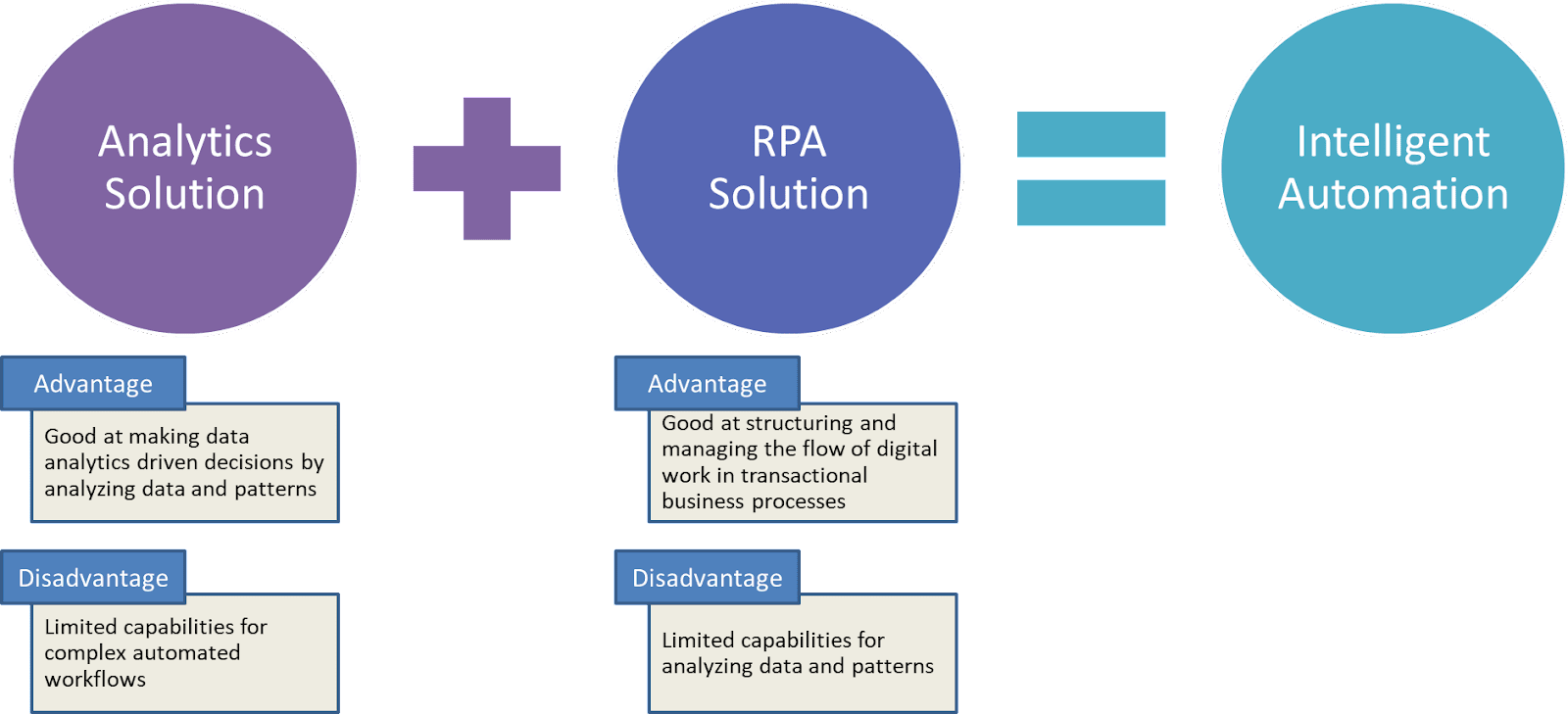

RPA helps in structuring and managing the flow of digital work in transactional business processes. However, it has a limitation when it comes to analyzing data and patterns. As a result, it is important RPA is combined with Analytics Solution that will help drive decisions by analyzing data and patterns, which results in providing intelligent automation solutions. Intelligent Automation is a combination of RPA and AI technologies which together aid in business automation and accelerate digital transformation.

In today’s time when money laundering is a critical and rising concern worldwide and is violating the financial services system in many countries, many technology solutions for Anti-Money Laundering (AML) have been introduced which have capabilities to identify money laundering and malpractices. However, it is important to drive efficiency in AML investigations for which RPA plays a crucial role in Financial Institutions. It is important to make AML investigations efficient due to challenges like a high number of false positives in AML alerts which results in financial institutions spending a lot of their time investigating non-critical alerts. Additionally, analysts end up spending more than 75% of their time in collecting data instead of focusing on analysing alerts during the investigation process. With the help of RPA, manual effort can be minimized through automated data collection from internal and external sources (e.g. web scraping). AI/ML powered SAS AML solution also helps in screening the alerts and separating the critical alerts from the non-critical ones, therefore minimizing human error and saving time by optimizing false positives.

Moreover, Financial Institutions aspire to have data-driven and automated payment screening processes in place and RPA can help bring efficiency in the payment screening process. ABG offers payment screening solution which leverages AI/ML technologies to analyse payments including analysis of risk factors, extracting insights from remarks through NLP, fuzzy matching entities and other processes. In addition, RPA allows Financial Institutions to minimize human intervention and inculcates an automated workflow for payment approvals or rejections, thereby simplifying the process and achieving quicker outcomes.

RPA is gaining momentum in transforming anti-money laundering with financial institutions increasingly pivoting towards business automation through customised and effective solutions for seamless integration, while reducing risks and costs. The increased demand for efficiency will only propel to fight against financial crimes such as transactional security issues, terrorism, organized crime, corruption, and other pressing issues.

Kindly note that, Accord Business Group offers end-to-end software solutions to the customers, in association with all its partners.

MORE ARTICLES